If you are interested in passive earnings with cryptocurrencies, then liquidity mining is definitely worth your attention. A liquidity pool is a game-changing solution for decentralized exchanges to maintain liquidity by attracting community members’ funds. For that, the so-called liquidity providers receive a portion of rewards generated out of trading fees.

We will take a closer look at Uniswap – one of the first DEXes that integrated an automated market-making solution.

Two years after the launch, the project implemented liquidity pools in Uniswap V2. This resulted in drastic DEX growth not only in utilization but also in the number of projects built on top of it, such as PancakeSwap and SushiSwap.

On May 5, 2021, the Uniswap team released the third version of its DEX planned to be realized on Optimism’s layer-2 solution. Notably, the combined daily trading volume on Uniswap V2 and V3 surpassed 1,1 Bn in USD value (as of 22 August 2021).

Why does concentrated liquidity mean higher returns?

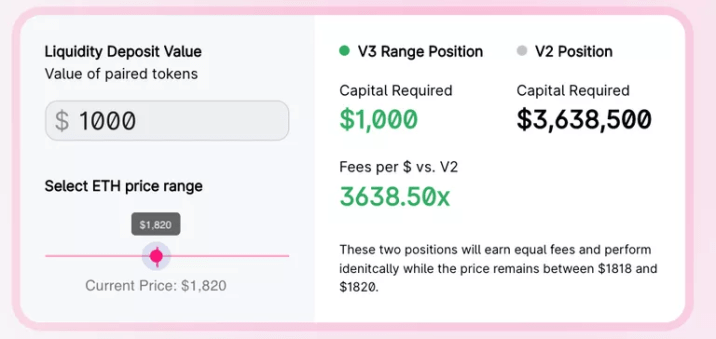

What interests us the most is a new concept called concentrated liquidity. This feature not only provides liquidity providers (LPs) with more options but also enables capital efficiency gains up to 4000x over the existing protocol.

On Uniswap V2, LPs technically provide liquidity over the entire range of assets’ possible prices. However, some coins are only traded within a small liquidity window, such as $0.999 and $1.001 for USDT/DAI pair. Thus, liquidity outside this price range is ineffective and, what’s more important, the pool’s participants bear a higher risk of slippage or impermanent loss (see the chart below).

To increase capital efficiency, Uniswap V3 allows liquidity providers to set “price ranges”. It allows the pool to provide more liquidity around actual likely prices preferred by traders. Since LPs receive rewards only when the capital is used, it allows them to maximize return.

So how much can I earn with Uniswap V3?

Let’s compare the potential income from liquidity provision on Uniswap V2 and V3.

According to LiquidityFolio, the forecasted yield for the ETH/USDT pool on Uniswap V3 is 1.67% per month considering the 0.68% impermanent loss. Thus $1,000 investment in the pool will bring you approximately $203 in one year.

The same $1,000 investment in WETH/USDT pool on Uniswap V3 in the price range of $2,875 – $3,455 will bring you $0.98 per day. That means 46.04% APY!

[It is important to notice that the risk of impermanent loss is not included in the V3 version calculations.]

Forecasted returns on the $1,000 investment in both pools are presented in the table below.

Some future considerations

As we have seen from calculations above, liquidity miners are able to earn approximately twice higher rewards due to capital efficiency. However, the concentrated liquidity model has drawbacks. Outside of the set price range, your capital is not actually used. That means if the price exceeds the defined range, you will not receive any rewards.

So, if you are planning to mine liquidity on Uniswap V3 you need to work out your own strategy. You can read about more options to make passive income with DeFi in our next articles.